Portions of this article were featured in Forbes: Robinhood’s Missteps Underscore Importance Of 4 Crisis Communication Rules

How did Robinhood, the company whose mission statement claims they “democratize investing for all,” become the villain in the infamous Gamestop-Wall Street hedge fund historic short squeeze that has the financial system upended?

It is an age-old tale of crisis communications missteps.

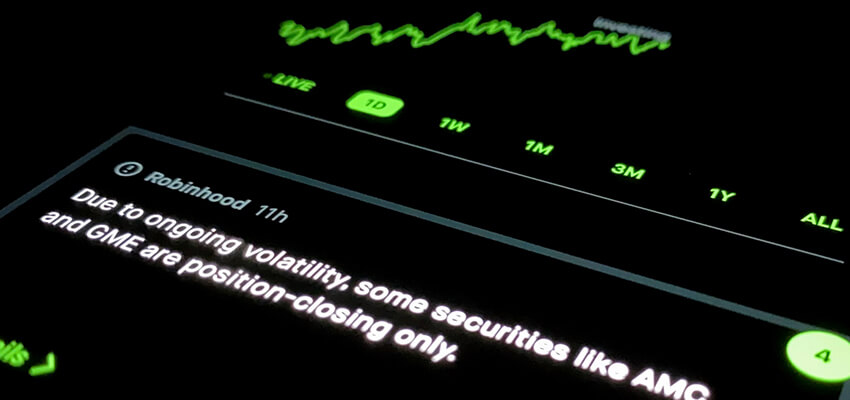

Robinhood, the commission-free stock and investing app that millions of retail investors used to drive up stock prices, quickly became the villain after the company and its CEO failed to clearly communicate why it prevented its users from buying shares or call options on volatile stocks like GME, AMC and others.

Making matters worse, Robinhood and its CEO Vlad Tenev never communicated about the decision until the evening news and an entire day of trading had already transpired with millions in confusion. Robinhood’s silence prompted theories that Robinhood was helping big hedge funds that pay it for order data at the expense of millions of retail investors.

After the market closed with about 12 hours of relative silence, Tenev appeared on top national news shows, notably CNBC and CNN to try to explain the company’s position. He exacerbated the crisis by showing little empathy, providing confusing financial jargon and explanations and disregarding his customers’ anger and frustration.

Take a look:

Robinhood betrayed the trust of its customers by restricting their ability to purchase specific stocks without communicating why they did so. Once they began communicating to the public via the media, Tenev provided answers that were not relatable, unclear and did not correct misinformation that became the prevailing narrative.

As a result, Robinhood became the villain, and was skewered across social media and continues to be negatively impacted by the reputational fallout.

Online, Tenev’s interviews were not received well:

1. The CEO and co-founder of Robinhood @vladtenev is on CNBC right now with @andrewrsorkin.

— Yashar Ali 🐘 یاشار (@yashar) January 28, 2021

He denies that they have a liquidity problem and says there's a lot of interest in the app right now pointing to its #1 status in the app store. pic.twitter.com/MD3ilgdDtF

#RobinHood CEO Vlad’s interview on CNBC in summary:

— Fazir Ali (@KingFazir) January 29, 2021

“Teams are working hard”

“Doing all we can”

“We care about our customers”

Sure bro.

Sure.

The Takeaway: CEO Crisis Communications Lessons from Robinhood

Tenev’s missteps provide a learning lesson for all CEOs, communications teams and spokespeople of what not to do, and we will outline below top crisis communication tips to prevent companies from having their own Robinhood misstep, and keep control of the narrative and avoid becoming the villain:

Communicate Clearly to Consumers Before the Crisis or As Soon as Possible

None of Robinhood’s retail investors had any idea Robinhood was considering preventing them from purchasing specific stocks until they abruptly did so.

The everyday investors also had no idea why they did it when they did–it was a surprise finding once consumers tried issuing purchase orders and were denied.

This lack of transparency and proactive communication created frustration, anger and resulted in a mass sell-off, and viral anger and theories that fomented online rapidly.

Have a Crisis Communications Plan in Place to Circumvent a Crisis Before it Becomes a Wildfire

Robinhood sat silent for the entirety of the trading day. In today’s viral digital ecosystem, waiting about 12 hours to confront a crisis and communicate transparency is enough to bring down entire companies.

Robinhood should have immediately communicated via all available channels why it made this decision, and what its next steps were. Silence created a vacuum for misinformation and conspiracy theories.

Show Empathy With Consumers–Understand Their Frustration and Avoid Jargon

In interviews with Andrew Sorkin of CNBC and Chris Cuomo of CNN, Telev never apologized or showed empathy that he understood retail investors’ confusion and anger.

His talking points were technical, explaining that the decision was based on “net capital and clearinghouse deposit obligations.” No common retail investors knew what this meant. This jargon was nonsense to the millions of everyday, novice investors.

Telev also touted that Robinhood was the number one app on Apple’s store twice, and that he emphasized with the CEO of Clorox antibacterial wipes for having empty shelves at the height of the pandemic. These statements showed a shocking lack of empathy or understanding of context, and created “meme-able” content online and increased anger.

Telev should have said in clear, succinct language that he and Robinhood understands their anger and confusion, and are sorry for missing the mark. Then, clearly explain steps that are taken to rectify the situation.

Not only does Robinhood have a significant user trust problem, this crisis may have threatened its planned IPO and may create legal and political ramifications. The SEC issued a stark letter indicating it will investigate this incident and bipartisan political forces are seeking congressional hearings, spearheaded by Rep. Alexandra Ocasio-Cortez and Sen. Ted Cruz–the unlikeliest of pairings.

By failing to act in a transparent and proactive fashion, Robinhood has created existential challenges for its company that could have been avoided if only they communicated quickly, clearly and apologetically right away.

Robinhood became the villain by its own communications missteps.